i.MAS and SAF-T in Lithuania

VAT reporting requirement i.MAS was introduced in 2016 for large organizations. It became mandatory for all companies in 2020.

i.MAS has three main parts, which are called i.SAF, i.VAZ and i.SAF-T.

- i.SAF invoice data: This XML electronic register of sales and purchase invoices is submitted monthly with the VAT return by the 20th of the month following the reporting period. All VAT-registered businesses must complete the submission.

- i.VAZ transport/consignment document: XML data supporting documents for domestic movements of goods by road.

- i.SAF-T: Accounting transaction reporting for resident businesses only. Currently, it is required only on demand by tax authority.

i.SAF: All taxable persons registered for VAT must submit “i.SAF” (data on VAT invoices issued and received under its Lithuanian VAT number) to the Tax Authority’s system.

It is submitted in XML format on a monthly basis (by the 20th day of the following month).

SAF-T (or i.SAF-T): SAF-T accounting transaction reporting only for resident businesses. This is mandatory only on request.

i.SAF (Mandatory)

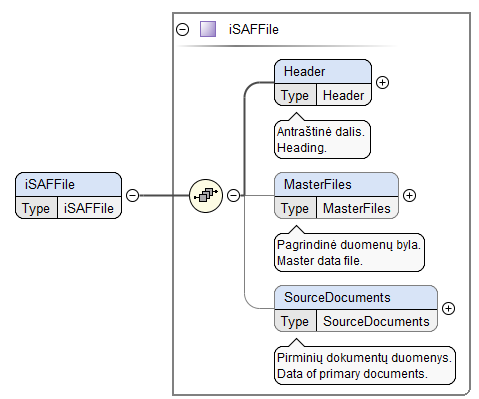

Header (Mandatory)

The header consists of the general information on the person whose registers are provided, tax period, file type, etc.

Master File

The master file consists of data from registers of issued and received VAT invoices that are linked to the data of source documents by the unique code of the buyer and/or supplier used in the accounting system of the entity. The completion of the master file is recommended when multiple VAT invoices with the same buyer or supplier are registered over the tax period. The master file may not be entered, but in that case, the register data of buyers and suppliers must be presented in the data of source documents.

Source Documents

The data of source documents consist of the data from registers of received and issued VAT invoices and payment details. The data of source documents may not be entered if no VAT invoices were received or issued during the tax period (in that case only the header of i.SAF data file shall be filled in). The provision of payment details shall be recommended when the entity wishes to use a preliminary VAT return preparation service.

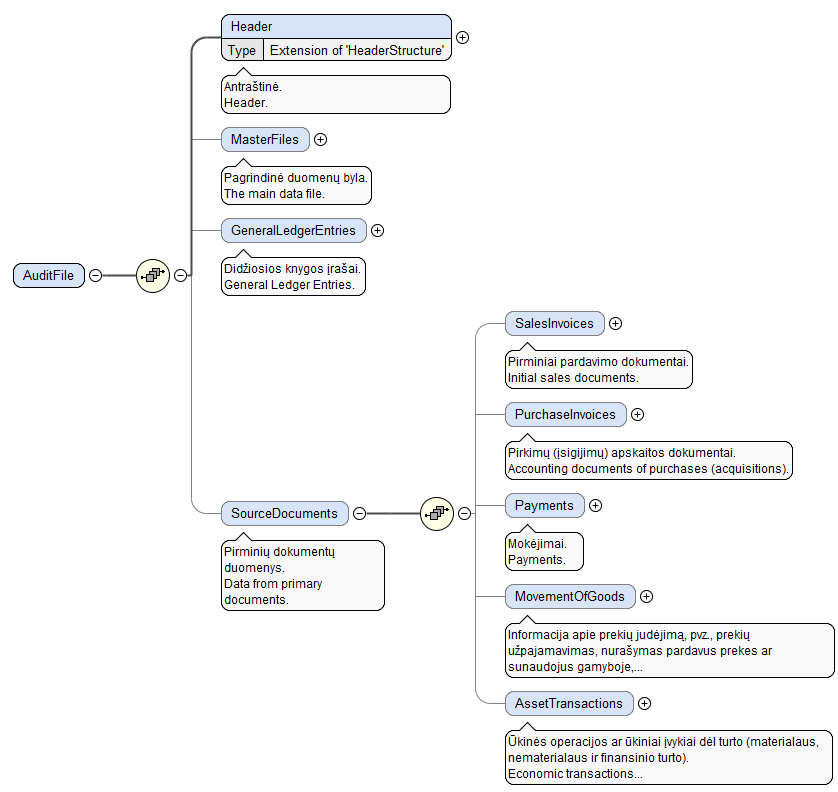

SAF-T (On-request)

SAF-T files could be sent fully or in divided versions.

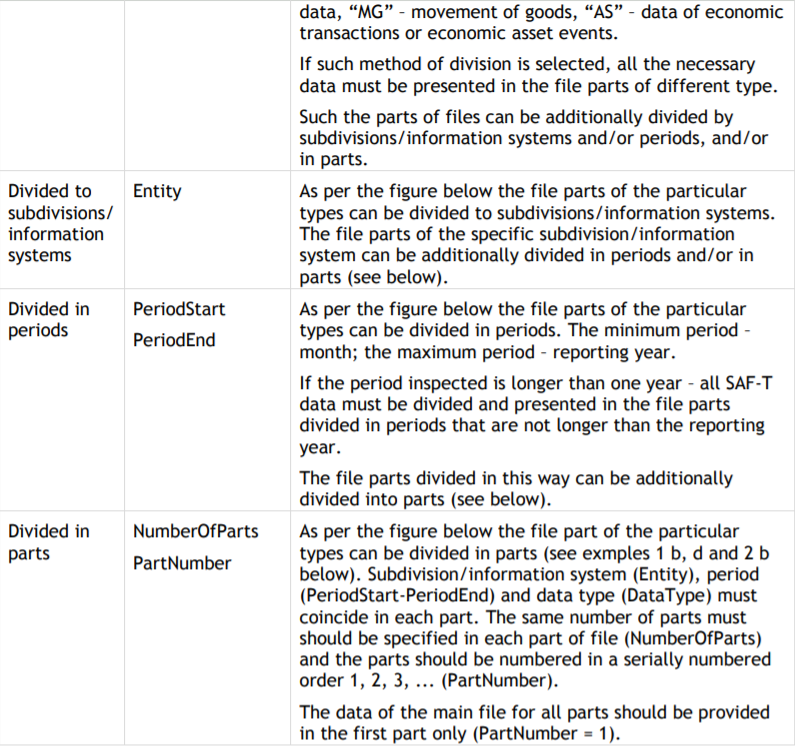

The figure below depicts and the table below presents the explanation of SAF-T file division alternatives.

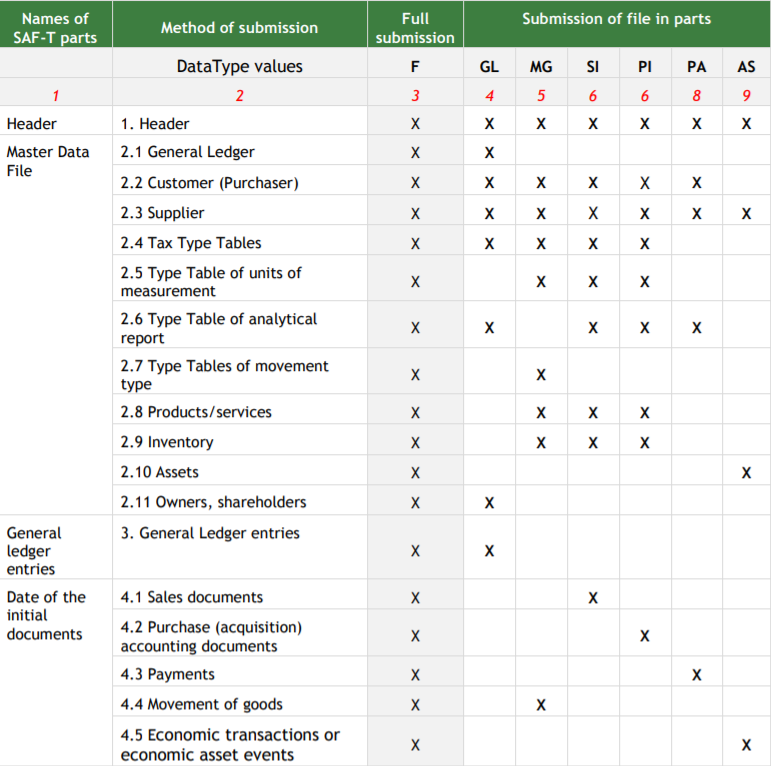

The table below presents the rules explaining what should be filled out in the part of the file of each type. Only the data groups marked with an X can be submitted in the part of the file of each type. If data in the data group not marked with an X are submitted in the part of the file of a particular type, they will be ignored and will not be saved in SAF-T. The marking of a data group with an X does not indicate obligation of data. The rules of obligation of data are provided in the technical specification of SAF-T, next to the appropriate item/data group.