In Peru, electronic invoicing began in 2014 with the PRICOT, which are the biggest taxpayers in the country. In 2022 new companies were included to finalize the adoption of the electronic invoicing process. The electronic invoice in Peru is called the CPE and is regulated by the SEE system. Users of this system must meet certain technical requirements and must communicate online with the Peruvian tax authority (SUNAT, Superintendencia Nacional de Aduanas y de Administración Tributaria).

To participate in this business framework, all taxpayers are required to enroll in the electronic invoicing system and engage the services of both a PSE (electronic service provider) to create and submit invoices or receipts to SUNAT, and an OSE (electronic services operator) responsible for validating these documents on behalf of SUNAT.

Technical details of the electronic invoicing system

In summarizing the country’s electronic invoicing scheme, it is crucial to note that the PSE is responsible for creating a document format specified by SUNAT, which in this instance is XML-UBL. This format must include all the required information for this particular type of voucher.

After the XML-UBL document is generated, a digital signature must be added to the invoice to ensure both confidentiality and authenticity. Subsequently, this information is transmitted to the OSE for validation, leading to the issuance of a CDR (receipt certificate). This certificate serves as a confirmation of whether the invoice has been accepted or rejected. Following this step, the OSE takes on the responsibility of forwarding the information to SUNAT to include it in their records. Taxpayers are required to store these payment vouchers for a minimum of five years, and they have the option to rely on their chosen PSE for storage purposes.

How can SNI help you?

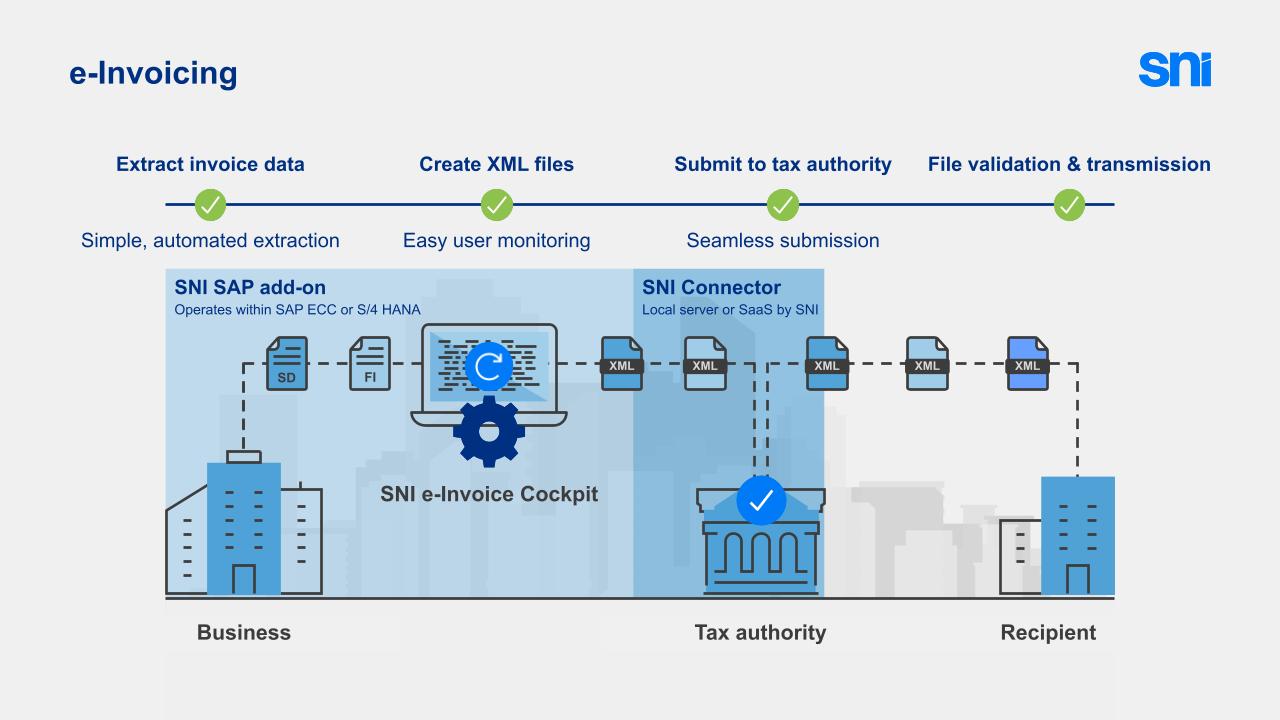

SNI offers a SAP add-on solution for the Peru B2B e-Invoicing system, starting with retrieving data and generating invoices in the desired format and exchanging these invoices with OSEs. Proof of the validation is the sign of CDR, added by the OSE. Data extraction, mapping and processing, and communication with the approved service provider can be done in SNI’s end-to-end SAP add-on solutions.